MOSERS Unauthorized Access

On December 11, 2014, MOSERS reported an unauthorized access to a limited number of MOSERS member records. While MOSERS serves as the administrator for the State of Missouri Deferred Compensation Plan, online participant account information for the deferred compensation plan is housed on a separate system. At this time, the Plan has not detected any suspicious account activity, but will continue to monitor the situation. As a reminder, participants are encouraged to regularly update their Account Access password to ensure the security of their online information.

December DC Update: A Deferred Compensation Carol

This month in the December DC Update, the Plan is proud to present A Deferred Compensation Carol. This fun twist on a classic holiday tale reminds savers that it’s never too late to take control of your retirement savings.

View the December 2014 DC UpdateNew Missouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective first quarter 2015 (January 1 - March 31, 2015) is 2.30%.

Retirement & Savings Survey Results

In late October, in conjunction with the 2014 National Save for Retirement Week celebration, the Plan conducted an online Retirement and Savings Survey. The survey polled active participants on a number of questions related to pension and social security calculations, income replacement in retirement, contribution decisions, and other savings habits. Over 4,000 participants completed the questionnaire. The feedback received not only offers a unique glimpse into participant behavior, but it helps the Plan refine future education and communication initiatives. A special thanks to those who took the time to complete the survey.

View the 2014 Survey Results (PDF)Black Friday Deals Start TODAY

The State of Missouri Deferred Compensation Plan’s Black Friday Ad has been leaked and the deals start as early as today. FREE training and one-on-one consultations, FREE Snapshot Financial Plans, waived penalties, plus so much more! View the 2014 Black Friday Ad and start saving today.

Thanksgiving Holiday Update

The New York Stock Exchange will be closed on Thursday, November 27, 2014 and will close early at 12:00 p.m. Central Time (CT) on Friday, November 28, 2014 in observance of Thanksgiving. Consequently, transactions will not be processed on Thursday, November 27 or after 12 p.m. CT on Friday, November 28. Transactions submitted via Account Access after 12 p.m. on Friday, November 28, will be processed as of the close of business on Monday, December 1. Despite the early closure of the New York Stock Exchange, the Plan Information Line will be available from 7:30 a.m. until 5 p.m. CT on Friday, November 28.

Have an enjoyable holiday weekend.

November DC Update: Slicing Up Savings

The November DC Update explores why pre-tax savings are an important deferred compensation plan feature. Plus, get to know your neighborhood education specialists and learn why they are a trusted source for Plan information.

View the NOVEMBER 2014 DC UpdateIRS Announces 2015 Contribution Limit Increase

On October 23, 2014, the Internal Revenue Service announced an increase in the annual maximum contribution amount for retirement plans in tax year 2015. These changes will directly affect the amounts you can contribute to the State of Missouri Deferred Compensation Plan.

Due to a rise in the cost-of-living index, the annual contribution limit for employees who participate in the Plan will increase from $17,500 to $18,000. For those 50 and over, the additional catch-up limit will increase from $5,500 to $6,000.

2015 Contribution Limits

| Elective Deferrals |

$18,000 |

| Pre-Retirement Catch-up Provision |

$18,000 |

| Age 50 and Over Catch-up Provision |

$6,000 |

The adjusted gross income (AGI) maximum limit to qualify for the saver's credit for low-and moderate-income participants will be $61,000 for married couples filing jointly (currently $60,000) and $30,500 for married individuals filing separately and for singles (currently $30,000).

For contribution adjustments to be effective on the first paycheck in January 2015, those changes must be submitted by the end of December 2014. Adjust contribution amounts online within Account Access or by calling the Plan Information Line at 800-392-0925.

For more information on these changes, visit the IRS website.

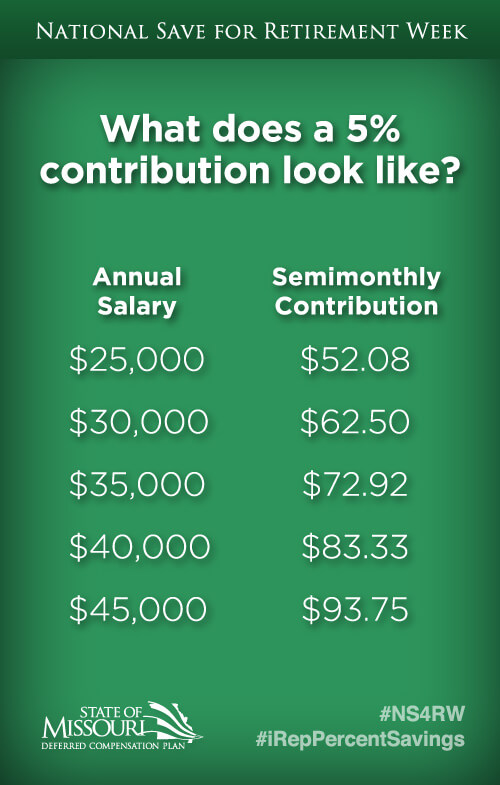

Find Your Five

This National Save for Retirement Week, the deferred compensation plan has been promoting the benefits of percentage-based contributions. While participants are free to choose any percent-of-pay amount they'd like, the image below is a simple illustration of what 5% of pay looks like in real dollars in a variety of salary scenarios.

National Save for Retirement Week

National Save for Retirement Week, running from October 19-25, has traditionally been a great time to promote enrollment in the State of Missouri Deferred Compensation Plan. But this year, Missouri savers have taken matters into their own hands.

Read MoreOctober 2014 DC Update: National Save for Retirement Week

Do you rep-percent savings? This month's update explores a simple account change that could make a world of difference to your savings strategy. Plus, learn why open enrollment period isn't the only time you can start saving with the Plan and why designating a beneficiary to your account is a must.

View the October DC UpdateNew Missouri Stable Income Fund Rate

The Missouri Stable Income Fund annualized credited rate effective fourth quarter 2014 (October 1 - December 31, 2014) is 2.25%.

September 2014 DC Update: Save with Confidence

Have you ever been approached by a financial professional advising you to transfer your savings to a different plan? If so, you're not alone. The September DC Update dives into why this type of transaction can be a costly one and discusses the fees and costs you should be aware of. Also in this update, see which seminars are coming to your area in September and learn about how late-career employees are beefing up their savings with the Plan's catch-up provisions.

View the September 2014 DC UpdateLabor Day Update

The New York Stock Exchange will be closed on Monday, September 1, 2014 in observance of Labor Day. Due to the holiday, transactions submitted via Account Access after 3:00 p.m. Central time (CT) on Friday, August 29, will be processed as of the close of business on Tuesday, September 2. The call center will reopen at 7:30 a.m. CT on Tuesday, September 2.

Have a great holiday.

Saving with Confidence

The State of Missouri Deferred Compensation Plan is an employee benefit created by state statute. As such, the salaries of Plan employees and its representatives are NOT tied to the amount participants contribute to the Plan or the investment options they choose within their accounts. Rest assured that any information you receive from the Plan is intended to be in your best interests.

A recent Bloomberg.com article focused on financial brokers who are advising federal workers to roll their retirement savings from a low-fee, employer-sponsored plan to more expensive individual retirement accounts. If a financial professional suggests that you transfer your account balance to another fund or IRA, there is one simple question you should ask yourself: “Are they acting in my best interests or their own?”

Read the full Bloomberg.com article: Brokers Lure Soldiers Out of Low-Fee Federal Retirement Plans"

Have a great holiday.

August 2014 DC Update: Now's the Time

Announcing an exciting new seminar that will help you complete the retirement income puzzle. Plus, get the scoop on what separates a 457(b) plan from a 401(k) and IRA.

View the August 2014 DC UpdateJuly 2014 DC Update: Where do you stand?

This month's update includes an important announcement regarding the employer incentive (match) program. Also in this edition, take a closer look at how your peers are using the deferred compensation plan benefit, and learn more about accessing your retirement savings in the "Now That's a Great Question" segment.

View the July 2014 DC UpdateIndependence Day Update

The New York Stock Exchange will be closed on Friday, July 4, 2014 in observance of Independence Day. Due to the holiday, transactions submitted via Account Access after 3:00 p.m. Central time (CT) on Thursday, July 3, will be processed as of the close of business on Monday, July 7. The Plan’s call center will reopen at 7:30 a.m. CT on Monday, July 7.

Have a fun and safe holiday weekend.

Incentive Funding Withheld from FY15 State Budget

Funding for the reinstatement of the employer incentive (match) program associated with the State of Missouri Deferred Compensation Plan has been withheld from the state budget at this time. This means that the funding for the deferred compensation incentive program will not be available in the Fiscal Year 2015 budget that begins on July 1, 2014. Generally speaking, withheld or "restricted" funds may be restored to the state's budget later in the fiscal year as deemed appropriate. For more on this budget action, view Gov. Nixon's press release.

Stay tuned to the Plan's website and social media channels (Facebook, Twitter, LinkedIn and YouTube) for more information as it becomes available.

June 2014 DC Update: Adding It Up with Percentage-Based Contributions

The June 2014 DC Update examines how percentage-based contributions could help you reach retirement savings goals. Also in this edition, the Plan recaps the 4-Week Savings Spree Challenge and releases the results of the anonymous Financial Status Survey conducted earlier this year.

View the June 2014 DC UpdateFinancial Status Survey Results

Earlier this year the Plan conducted an anonymous Financial Status Survey. Sent via email to all active Plan participants, this online questionnaire aimed to gain a better understanding of participants’ spending and savings habits. More than 4,300 state employees completed the online survey. The Plan will use the results to develop custom education and communications materials for Missouri savers.

View the Financial Status Survey results4-Week Savings Spree Challenge Recap

Connect, save, share!

Congratulations to everyone who participated in the 4-Week Savings Spree Challenge. Whether you shared a tip, liked a post, or simply followed along with the Challenge, we applaud your participation and support of the cause. Those who regularly save and put money away for the future are the real winners of the Challenge.

We are thrilled to announce there were 115 T-shirt recipients and 1,034 entries into the random prize drawing! If we did not have the pleasure of meeting you and personally handing you a shirt at the employee appreciation event, then an education specialist will deliver it to you within the next few weeks. Without further ado, we'd like to congratulate our random prize drawing winners:

- Dawna Keilholz - Goal-Specific Financial Planning Session ($175 Value)

- Brad Gibson - $15 Restaurant Gift Card

- Dawn Haslag - $15 Restaurant Gift Card

- Tracy Klug - $15 Restaurant Gift Card

Now the big question is...what will you do with all those savings? #MO4WSS #MOSavingsSpree

Memorial Day Update

The New York Stock Exchange will be closed on Monday, May 26, 2014 in observance of Memorial Day. Due to the holiday, transactions submitted via Account Access after 3:00 p.m. Central time (CT) on Friday, May 23, will be processed as of the close of business on Tuesday, May 27. The Plan’s call center will reopen at 7:30 a.m. CT on Tuesday, May 27.

Have a great holiday.

4-Week Savings Spree Challenge Recap

Week 4: Putting It All Together

The 4-Week Savings Spree Challenge has explored numerous ways to put money back in your pocket, but your journey is not complete. The final week of the Challenge will focus on the deferred compensation plan features that can put your savings to work and prepare you for a financially secure retirement.

Read More4-Week Savings Spree Challenge

Week 3: You’re paying what?

Week 3 of the 4-Week Savings Spree Challenge will try to add some green back to your life, and we're not talking about your lawn. This week we will focus our attention on trimming unnecessary expenses on items or services that you no longer use. You’d be amazed at how much you could save.

Read More4-Week Savings Spree Challenge

Week 2: Fun with Less Funds

Week 2 of the 4-Week Savings Spree Challenge has us itching for the open road. With summer a little over a month away, it's easy for your savings to melt away with travel plans and outdoor activities. But there are still ways for you to have fun, without burning through all of your funds.

Read MoreMay 2014 DC Update: Are you taking the challenge?

The May 2014 DC Update details the 4-Week Savings Spree Challenge – the Plan's month-long employee appreciation event that's open to ALL state of Missouri employees. Also, meet the Plan's newest education specialist and learn just how easy it is to enroll in the State of Missouri Deferred Compensation Plan.

VIEW THE May 2014 DC UPDATE4-Week Savings Spree Challenge

Week 1: There’s No Place (to Save) Like Home

The 4-Week Savings Spree Challenge kicks off in a familiar location – your home. That place where you eat, sleep and spend time with family is also ripe with money saving opportunities.

Read More4-Week Savings Spree Challenge

We've all been there. You stroll into the grocery store, grab a cart and get halfway down the aisle only to realize the cart you grabbed has a bum wheel. Without constant guidance, the cart veers off into shelves and oncoming traffic. As you navigate the aisles and add items, the cart becomes more difficult to steer. Do you abandon the cart or finish your shopping?

Read MoreHoliday Update

The New York Stock Exchange will be closed on Friday, April 18th in observance of Good Friday. Due to the holiday, transactions submitted via Account Access after 3:00 p.m. Central time (CT) on Thursday, April 17th will be processed as of the close of business on Monday, April 21st. The Plan's call center will reopen at 7:30 a.m. (CT) on Monday, April 21st.

First Quarter Statements

First quarter statements are now available online within Account Access. To view your statement(s), log on to Account Access and click the blue View Statements & Confirms button on the Account Summary homepage.

April 2014 DC Update

The April 2014 DC Update explores a classic savings example to explain the factors participants can control when building retirement savings. Also in this edition, take the stress out of employee training events with Education On-Demand, get to know the education specialists, and learn about a unique savings challenge launching later this month.

VIEW THE April 2014 DC UPDATEMarch 2014 DC Update

The March DC Update explores tools and tips for managing your account balance now and in retirement. This edition also highlights popular participant questions and the tax advantages of saving with the Plan.

VIEW THE March 2014 DC UPDATE5 Ways to Celebrate America Saves Week

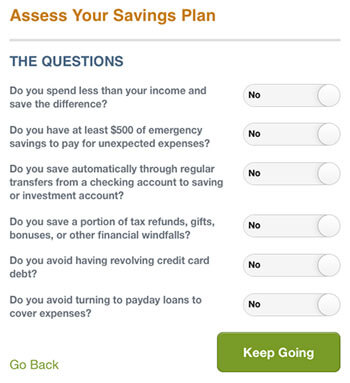

- Assess your Savings Plan

Before you can set goals and develop a savings plan, it’s important to review your current savings performance. The America Saves Week website offers a savings assessment tool that looks at your current savings habits to ensure you are saving for the right things. It takes minutes to complete and offers valuable feedback on what you’re doing well now and what you could be doing to improve your situation in the future. Assess your savings now. - Proclaim a Savings Goal

Financial goals are nice, but unless you dedicate yourself to reaching them, they’ll remain unattainable. Writing goals down and telling friends and family about your aspirations is a good place to start. Writing a goal down forces you to clarify what you want and motivates you to take action. In fact, a recent survey performed at Dominican University in California found that you are 42 percent more likely to achieve your goals by writing them down. Telling loved ones about your financial dreams will create a support system that can offer encouragement when times get tough and praise after achieving milestones. However you choose to go about it, remember to establish clear and attainable goals that will motivate you to make sound financial decisions. - Save your Tax Refund

This sounds simple enough, but some often wait until tax season to make major purchases with their refund dollars. If you’re looking for a way to instantly improve your financial situation, we recommend fighting that urge and saving your refund instead. The money could come in handy down the road in the form of emergency savings, or it could go a long way toward helping you achieve one of your savings goals. - Track your Spending

Modern technology has made it easier than ever to track your spending and create a monthly budget through your computer or smart phone. Mint.com and Budgettracker.com are two of the most popular products, though there are various other websites dedicated to budgets and spending. Mint.com, in particular, will securely link to your bank, savings and credit card accounts to produce a convenient snapshot of your financial situation. You can create savings goals and monthly budgets and set up email alerts for when you make progress or over spend, respectively. Better yet, this service is absolutely free. Sign up online or download the Mint app on your smartphone. - Register for a Free Financial Education Event There are a number of FREE financial education opportunities designed specifically for state of Missouri employees. Education specialists with the State of Missouri Deferred Compensation Plan provide financial seminars and one-on-one consultations at locations across the state. These seminars cover general investment topics and plan-specific features that help employees gain a better understanding of the deferred compensation plan benefit. MOSERS also offers FREE Pocket Change workshops designed for employees who want to know more about managing their finances. These workshops are available by special request from individual departments. Those interested should visit with their HR staff who may schedule a workshop onsite.

January 2014 DC Update: How much is enough?

It's never too early to start thinking about where money will come from in retirement and how much to expect from those anticipated sources. This month's DC Update outlines ways to estimate retirement income and the role the deferred compensation plan plays in the process. Plus, details on Gov. Nixon's proposal to resume the state match program and a note about an often unknown tax break.

VIEW THE January 2014 DC UPDATEEmployer Incentive Update

Governor Jay Nixon recently announced a proposal to resume funding of the employer incentive (match) associated with the State of Missouri Deferred Compensation Plan. If the budget recommendation passes, the funding would be part of the Fiscal Year 2015 budget beginning on July 1, 2014 and running through June 30, 2015.

At this time, the State of Missouri Deferred Compensation Plan has no further details regarding Gov. Nixon’s recommendations. While the employer incentive would add value to an already important employee benefit, the State of Missouri Deferred Compensation Plan plays no role in state budget requests or decisions. Before budget recommendations are implemented, the Missouri Legislature must first pass the state budget in May of this year and the final budget must be signed by the Governor.

More news will be posted to the Plan’s website and social media channels as it becomes available. You can connect with the Plan on Facebook, Twitter and YouTube.