Your Whole Story

2016 National Retirement Security Week

Saving for retirement doesn’t have to be complicated or difficult. Throughout National Retirement Security Week, we’ll be posting some of our favorite savings tips that can help you along your retirement savings journey.

NRSW Savings Tip #1: Check Your Progress

Regularly reviewing your deferred comp statement is an important step in saving for your future. Statements are issued on a quarterly basis and provided detailed information about your account with MO Deferred Comp. If you haven’t done so already, log in to Account Access to look at your 3rd quarter statement. Your current and previous statements can be found by clicking on Access My Accounts in the menu and then choosing Statements & Confirms on the left-hand side of the page.

Not sure what to look for on your statements? Here's a few things for you to review :

- Your contribution levels

- Fees you are paying

- Performance of investments

NRSW Savings Tip #2: A Winning Recipe

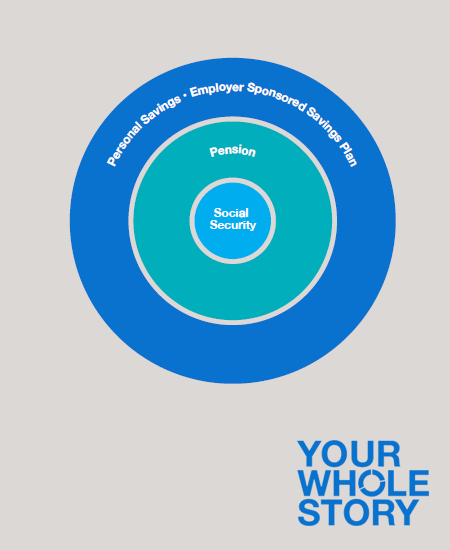

Saving for retirement is a lot like baking a cake, because all of the ingredients in the recipe serve a purpose. If you leave out one or the other, there's a good chance your recipe won't turn out. As a state of Missouri employee, your retirement paycheck is made up of three key ingredients: your Defined Benefit Pension Plan, Social Security, and MO Deferred Comp Savings (or other retirement savings accounts). Each of these components plays a huge role in replacing your pre-retirement (working) income. For more information, watch the 2016 third quarter DC Update, The Retirement Paycheck Recipe.

NRSW Savings Tip #3: The Easy Way to Save More

When’s the last time you checked your savings progress or adjusted your contributions to meet your goals? If you’re like most people, it’s been a while. Life is busy and keeping up with your retirement goals typically isn’t at the top of your to-do list. That’s why deferred comp offers several automatic features, like auto increase, to help keep you on track. Auto-increase is an optional tool that automatically increases your contributions by a percentage on an anniversary date of your choice. So while you’re running errands or picking the kids up from soccer practice, your savings plan is still hard at work, ensuring you meet your retirement goals. Watch MO Deferred Comp’s Auto Increase Explained video for more information on this powerful tool.

NRSW Savings Tip #4: Get on Target

Investing can be complex, which is why MO Deferred Comp offers a simple, savings solution to plan participants. Target Date Funds are a “one-stop-shop” for the everyday saver. They offer a diversified mix of investment options, rolled up into one package. The neat part about target date funds is that they adapt over time to ensure the investment lineup meets your age and retirement goals. Watch the Target Date Funds Explained video more for information on this custom savings option.

NRSW Savings Tip #5: Start As Soon As Possible

You’ve heard it a hundred times, the sooner you start saving something, anything, the better off you will be. Many employees assume they can start saving later in their career and catch-up on the time they have missed, but they can’t. Saving during the early years of your career is one way to reach your retirement savings goal and probably the easiest. Need an example? Watch the 2016 third quarter DC Update to see how saving now versus later can impact your total savings.