MO Deferred Comp Bulletin

Has 2018 kept you busy? If so, or if you haven't had time to check in with MO Deferred Comp, we've highlighted some of the most important information and news you need to know.

2018 America Saves Week - What's Your Excuse?

MO Deferred Comp focused their annual video campaign around common excuses people use to justify not saving for retirement. We encourage you to take 10 minutes out of your day to watch these hilarious, yet truthful videos. Click a video below to watch!

Paycheck Bumps from Tax Reform Present the Perfect Opportunity to Increase Retirement Savings

Have you looked at your paystub recently? If not, you should! According to a recent survey by LendEDU, Americans’ have seen an average increase of $130 per paycheck thanks to the 2017 tax reform legislation that became effective in January. Before you rush off and start spending those extra dollars, you may want to consider saving that money for retirement because retirement is on average the most expensive purchase you will ever make! Learn more.

Review & Update Your Beneficiaries

Saving money for your retirement is a crucial step in preparing for your future, however appointing a beneficiary is equally just as important. By designating a beneficiary and reviewing your appointee(s) on a regular basis, you are not only doing the right thing for yourself, but also for your loved ones. Log in to Account Access, call 800-392-0925, or complete the Designation of Beneficiary Form.

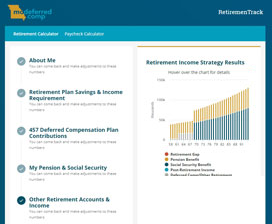

NEW: RetiremenTrack Calculator Redesigned

RetiremenTrack uses your personal information to develop a custom savings forecast that takes into consideration pension, social security, and personal savings. Use the RetiremenTrack calculator to help you with your retirement savings strategy.

Simply Put Newsletter: Understanding Your Paycheck

Getting your paycheck is something to look forward to, however it can be a little disappointing once you realize how much money isn't making it to your bank account. So where are all your hard-earned dollars going? The answers can be found on your pay stub. This short electronic document contains information regarding your taxes, insurance, retirement savings, and much more. By taking a closer look at this detailed document and truly understanding where your money is going, you can stay on top of your finances and make the most of your paycheck. Read the Simply Put Newsletter.