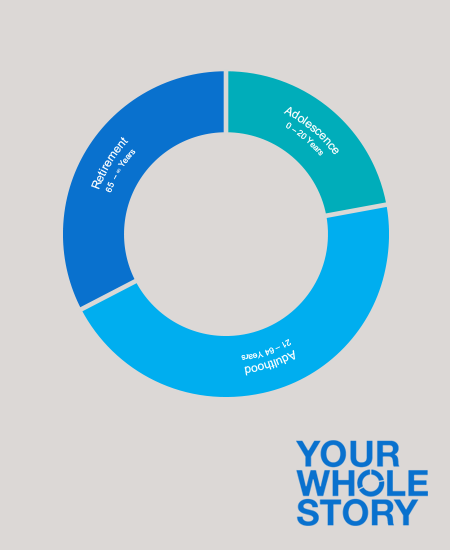

Your Whole Story

2018 National Retirement Security Week

Your savings strategy depends on your personal situation: What's going on in your life? How long do you plan on working? What expenses can you cut back and which ones are an absolute necessity? It's all about you and your ability grow your retirement savings large enough to produce a fruitful outcome in retirement. This National Retirement Security Week, we encourage you to take time to consider Your Whole Story, the Retirement Garden edition.

NRSW Savings Tip #1: Start As Soon As Possible

We understand, long-term goals can seem daunting and unattainable. However, when it comes to saving for retirement, the earlier you start the easier it will be to reach your savings goal. By saving early in your career, your money will have more time to grow allowing compounding interest to work for you. Trust us, giving up those small sacrifices today and investing in yourself now will help provide for a more affordable future. Watch the DC Update, How much should you be saving? for more.

NRSW Savings Tip #2: Check Your Progress

Are you reviewing your deferred comp statement quarterly? If you haven't checked your statement in some time, you could be missing out on vital information. Statements contain details such as your contribution levels, fees you are paying, the performance of investments and more. If you haven't already reviewed your 3rd quarter statement, log into Account Access. You can also review current and previous statements by clicking on Access My Accounts in the menu and choosing Statements & Confirms on the left-hand side of the page.

NRSW Savings Tip #3: The Easy Way to Save

Don't let the term 'investing' deter you from saving. MO Deferred Comp's target date funds are a simple, and smart savings solution for plan participants. These funds offer a diversified mix of investment options all in one place. Target date funds are also effortless because as your anticipated retirement date draws closer, the target date fund allocation will shift automatically from more aggressive to more conservative to better align with your age and retirement goals. Want to know more? Watch the Fall 2017 DC Update to learn more about deferred comp's simple investment lineup.

NRSW Savings Tip #4: The Easy Way to Save More

Between work, travel, raising kids, running errands, and other important daily adventures, life can get busy! That's why MO Deferred Comp created the auto increase tool. Once setup, it will automatically increase your contributions by a percentage (in as a little as 0.1% increments) on an anniversary date of your choice. So enjoy life's little adventures, while knowing you're saving's plan is working hard to meet your retirement goals. Check out the DC Explains video Auto Increase Explained to learn more.

NRSW Savings Tip #5: How long are you going to live in retirement?

Knowing how much you'll need saved up for retirement is impossible to calculate. Rising health care costs, your length of time in retirement, debt, altering life situations must all be factored in when considering how much you should have saved. That's why it's important to start saving early and often. When the future is unknown, it's best to be prepared to make up for those extra expenses. Learn how you can be better prepared for retirement by watching the Summer 2018 DC Update. (Oh and don't worry, the DC Update isn't just for women!)