2016 Contribution Improvements

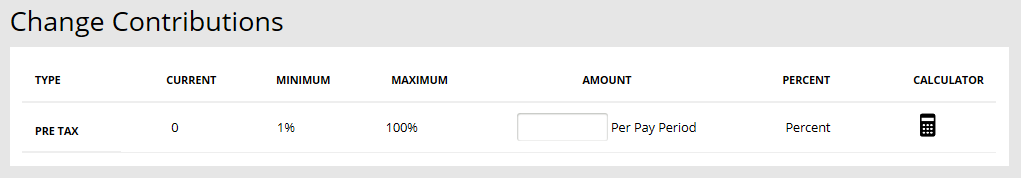

Effective December 18, 2016, future contributions to MO Deferred Comp can only be made in a percentage format. Just like the name suggests, percent-of-pay contributions are a retirement savings amount based on a percentage of your pay. Contributions can be made at a minimum of 1% and adjustments can be made in as little as 0.1% increments. Current dollar-based contributions will remain in a dollar form until a deferral change is made by the saver.

If you’re wondering why the change, the answer is simple: Percent-of-pay contributions are an automatic way for a saver to maintain their savings strategy as their career evolves. Plus, saving with percentage-based contributions has many advantages over traditional dollar deferrals, including:

- It allows deferrals to deferred comp to evolve with an employee’s career. This means if an employee’s salary changes – due to a raise or promotion, for instance – so will the participant’s retirement savings contribution.

For example, if you earn $1,000 each paycheck and contribute 2.5% of your pay to the deferred compensation plan, that’s the same as saving $25 with each check. If a saver’s pay increases to $1,500 each paycheck their new contribution would automatically change to $37.50 per pay period.

For those participants who prefer dollar deferrals, MO Deferred Comp created a custom easy-to-use calculator to help make exact dollar-to-percent conversions. Savers can also use the conversion calculator within Account Access on the Change My Contribution page. These robust tools allow you to contribute a specific amount, while still benefiting from saving with percentage-based deferrals. -

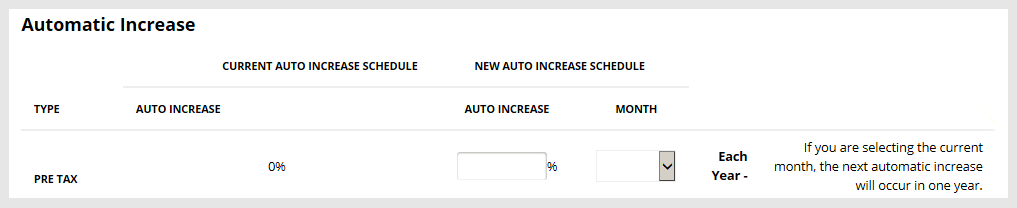

Percent-of-pay contributions also allow savers to take advantage of the plan’s auto increase tool. Auto increase is a voluntary feature that will automatically adjust a saver’s percentage-based contribution (in as a little as 0.1% increments) on an anniversary date he or she chooses. This tool allows plan participants to grow their savings contributions each year without significantly affecting their take home pay.

Percent-of-pay contributions also allow savers to take advantage of the plan’s auto increase tool. Auto increase is a voluntary feature that will automatically adjust a saver’s percentage-based contribution (in as a little as 0.1% increments) on an anniversary date he or she chooses. This tool allows plan participants to grow their savings contributions each year without significantly affecting their take home pay.

For an example of how auto increase works, all savers are encouraged to use our new Grow Your Retirement Savings calculator. This calculator shows how making regular contributions along with yearly small increases can make a big impact on your total retirement savings.

How to change your contributions?

- Log on to your account through the ESS portal or through Account Access.

- In the menu, click the Access My Accounts option.

- Choose Contributions in the left-hand menu.

- Click the Change My Contribution Amount button at the top of the page.

- Type in your contribution percentage.

- Click the Next button and follow the prompts.

How to sign up for auto increase?

- Log on to your account through the ESS portal or through Account Access.

- In the menu, click the Access My Accounts option.

- Choose Contributions in the left-hand menu.

- Click the Change My Contribution Amount button at the top of the page.

- Navigate to the Automatic Increase form at the bottom of the page.

- Enter a percentage amount you’d like your contribution to increase each year. (Remember, increments can be as little as 0.1% and changed at any time.)

- Select which month you’d like the increase to occur.

- Click the Next button and follow the prompts.